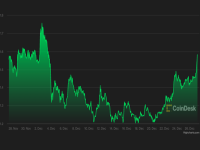

Major cryptocurrencies including bitcoin and ether regained price levels from Friday after seeing a slight dip over an otherwise quiet Christmas weekend.

The tokens of Cardano (ADA) and Polkadot (DOT), two rivals to the Ethereum blockchain, led gains among major cryptocurrencies amid a muted recovery in broader digital-asset markets on Monday.

Bitcoin (BTC) and ether (ETH), the native cryptocurrency of Ethereum, regained price levels from Friday after seeing a slight dip over an otherwise quiet Christmas weekend.

Bitcoin failed to break above the $51,000 resistance level on Saturday and fell to $49,700 on Sunday, but traders have since bought the asset back to last Friday’s $50,900 level.

ADA gained 9.5% in the past 24 hours to reach a resistance level of $1.56 during European hours on Monday. The move came after Cardano founder Charles Hoskinson spoke of improved network enhancements in 2022 and efforts for more adoption of ADA in countries such as Africa in a public broadcast.

The Relative Strength Index (RSI), a price-chart indicator, turned overbought on ADA following the move. The tool calculates market momentum for assets. An overbought level implies prices are overvalued and may be primed for a trend reversal or corrective price pullback.

DOT prices rose in the past week as the Polkadot blockchain’s second batch of parachain auctions went live. The cryptocurrency saw similarly overbought levels after an 8% surge to $31.70 in the past 24 hours. Charts showed strength as dips to the $30.80 level in Asian hours were bought up by traders.

Parachains are distinct blockchains that run atop the main Polkadot blockchain. Polkadot, however, has a limited number of slots that can support such parachains, meaning winning slots are subject to a community-run auction that uses DOT to vote for slots, leading to increased demand for the cryptocurrency.

Among other large-cap cryptos, tokens of decentralized exchange Uniswap (UNI), which relies on smart contracts instead of third parties to execute crypto-to-crypto trades, rose 12% in the past 24 hours to $19.25 on Monday.

Other “blue chip” decentralized finance (DeFi) tokens from 2020 saw similar price jumps. Tokens of lending protocol Aave (AAVE) and synthetic exchange Synthetix (SNX) were up 10% in the past 24 hours, while tokens of DeFi platforms Sushi (SUSHI) and Yearn Finance (YFI) were up 7% in a comparable period.

The moves followed chatter among crypto traders on Twitter that token prices of relatively older DeFi applications on Ethereum had turned undervalued – compared to their fundamentals – and could see capital inflow.

Jay Hao, CEO of crypto exchange OKEx, said DeFi tokens would see a further rise in 2022.

“As the crypto industry evolves and investors gain more knowledge about crypto assets, we will see more investments in specific coins which belong to blockchain playing pivotal role in decentralized finance,” Hao said in an email to CoinDesk.

Source Shaurya Malwa CoinDesk

Last edited: